ZOETIS: ZTS

Exchange: NYSE

Share price: US$173*

Market cap: US$81 billion*

GICS sector: Healthcare

Industry: Pharmaceuticals

*as at 10th July 2024

THE RUNDOWN

What is the business?

Zoetis is a global animal health company dedicated to supporting veterinarians, livestock producers, and pet owners in their efforts to raise and care for animals.

The company develops, manufactures, and markets a wide range of products for both livestock and companion animals.

WHEN WAS IT FOUNDED? AND HOW?

Zoetis is actually a spin off from the massive global pharmaceutical company, Pfizer. It was spun off in 2013 and it allowed Zoetis to concentrate on its specialized market of animal health while Pfizer continued to focus on its core pharmaceutical business.

What are the products?

They have products for every kind of animal, from cats to cows. Think of it as the Walmart of the animal health world—one-stop shopping for all your furry, feathered, and hooved friends!

Their products include:

Vaccines: To prevent diseases in animals.

Medicines: To treat various animal health issues, including antibiotics, anti-inflammatories, and parasiticides.

Diagnostic Products: Tools and tests to help veterinarians diagnose health issues in animals

Genetics: Products and services to support animal breeding programs, particularly in livestock.

Biodevices: Advanced devices for animal health management.

Who is the CEO?

Kristin Peck (yes, a female!) is the current Chief Executive Officer (CEO) of Zoetis.

She has been CEO since January 2020. Prior to her role as CEO, Kristin Peck held various executive positions within Zoetis.

As of 2024, there are 41 female CEOs leading companies in the S&P 500...Kristin is one of the 8% of female CEOs! Other female CEO's include General Motors, Citigroup, Walgreens Boots, UPS...

She owns 80,100 shares which is approximately 0.02% of all the company's public shares. That's about $14m worth.

Which countries does it operate in?

The company’s head office is in New Jersey, US but Zoetis operates in over 100 countries, providing a broad range of products for pets and livestock.

And with around 100,000 employees, Zoetis has nearly as many staff as Hamilton (a town in NZ).

WHO IS THEIR CUSTOMER?

Surprisingly, it's not cats, dogs or pigs, but the people who look after the animals. ZTS sells its products to mainly Vets but also farmers, pet owners, pet retailers, Government (for disease control and food safety etc) and research institutions like Universities.

THE NITTY GRITTY

What industry does it operate in?

It straddles two very high growth industries; healthcare and pet care.

The increase in diseases means that therefore there is a continued need for vaccinations

Is the industry growing?

During the COVID-19 pandemic, there was a significant increase in pet ownership. Approximately 23 million American households, or nearly one in five, acquired a cat or dog since the beginning of the pandemic.

In Australia, the number of pets increased dramatically, with an estimated 30.4 million pets across the country, up from 28.5 million in 2019. About one in five dogs and a quarter of all pet cats were acquired during the pandemic!! Wow!

WHAT IS ITS MARKET SHARE?

Zoetis is a major player in the animal health industry, holding a significant market share globally. It is also continually innovating and spending on researching and developing new products.

Zoetis holds the largest market share in the animal health industry.

THE FINANCIALS

In financial year 2023, revenue was $8.5 billion and it has achieved an average of 7% revenue growth over last 10 years. It also generated $2 billion profit!

The company has $2 billion in cash and nearly $7 billion in debt, resulting in a net debt of approximately $5 billion

Zoetis has updated its guidance for 2024, expecting revenue between $9.05 billion and $9.2 billion, with operational growth projected between 8.5% and 10.5% on the 2023 year

Zoetis maintains impressive profit margins, with a gross margin of 70% and a net profit margin of 27%

Do they pay a dividend?

Zoetis pays a dividend. As of 2024, the company has announced a quarterly dividend of $0.375 per share, which represents a 13% increase from the previous dividend.

So, if you owned 1000 shares of ZTS ($100k), you would get a $375 each quarter!

THE SHARE PRICE

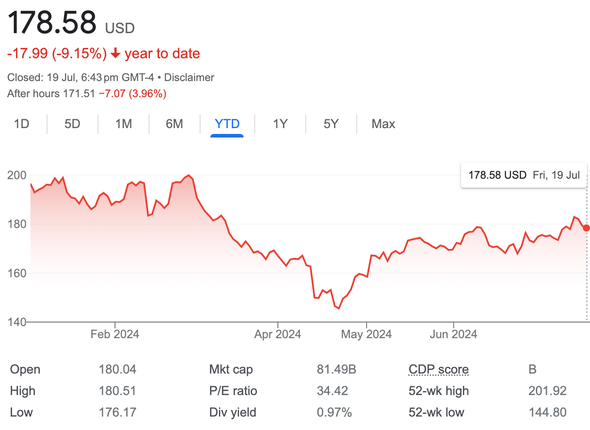

YEAR TO DATE (YTD) 12% vs S&P +19% - short-term issues = OVERALL POSITIVE

LAST 12 MONTHS: +2% vs 27%

Since IPO, ZTS share price has increased from $30/share to a huge $170. A return of 19% per year!

(The market has done 10% per year on average)

Key things to note: Zoetis Have not yet done a stock split

THE RED FLAGS

Think: Industry, competitors and company specific.

The Industry Flags:

While it might seem counterintuitive, disease outbreaks can have complex impacts on companies like Zoetis...

Positive Impacts;

Increased Demand for Products as during disease outbreaks, the demand for vaccines, medications, and diagnostic products often rises sharply benefitting Zoetis.

Increased focus on biosecurity which would benefit a company like Zoetis, with its broad portfolio of preventive products

Disease outbreaks can spur innovation and research within the company. Zoetis invests heavily in R&D to develop new vaccines and treatments, which can lead to long-term benefits and strengthen their market position

Negative Impacts;

Outbreaks can disrupt supply chains, affecting the production and distribution of Zoetis products. This can lead to delays and increased costs, impacting the company’s ability to meet demand e.g COVID-19 pandemic

Widespread outbreaks can lead to economic downturns, which might reduce spending on animal healthcare as both livestock producers and pet owners cut back on non-essential expenses.

Rapid outbreaks often lead to new regulations and operational challenges that can complicate business operations for company's like Zoetis.

The COMPANY Flags:

Top 10 products account for more than 50% of revenue meaning it isn't very well diversified and if something goes wrong with one, it could really impact its revenue.

Zoetis recently acquired a smaller competitor with a similar product only to shut it down shortly after it acquired it. Zoetis is now being investigated by EU trading commission for anti-competitive behaviour.

THE VIBE CHECK

The Good Vibes

Innovative and spends a lot on R&D ($600m actually) which creates a very defensible moat

The recurring nature of their products

The good vibes

Its straddles two growing sectors; pet care and healthcare

Female CEO

THE BAD VIBES

Its top 10 products account for more than 50% of revenue

THE BAD VIBES

The CEO doesn’t own many shares