TJX COMPANIES: TJX

Exchange: NYSE

Share price: US$109*

Market cap: US$124 Billion*

GICS sector: Consumer Discretionary

Industry: Specialty Retail

*As at 10th July 2024

THE RUNDOWN

What is the business?

TJX Companies is a leading ‘off-price’ retailer, which means they sell high-quality, brand-name and designer products at lower prices than regular retail stores. If you’re in NZ, think of ‘DressSmart’ or like an outlet store.

Their mission is to offer great value to their customers through a constantly changing assortment of products from handbags, to clothing, to homewares. They pride themselves on constantly refreshing their products, kind of like a Zara.

What are the products?

It operates over 4,900 stores across NINE countries, and across seven different brands (below), but the majority of these stores are in the US.

Marshalls: Another significant off-price retailer in the U.S. similar to T.J. Maxx, offering apparel, footwear, home goods, and more/ HomeGoods: A U.S. retailer specializing in home furnishings and decor.

Sierra: A U.S. retailer focused on outdoor and active lifestyle gear and apparel at discounted prices.

Winners and Homesense - Based in Canadian off-price retailer offering a variety of brand name and designer fashions.

TK Maxx: The European counterpart to T.J. Maxx (the US version), operating in countries such as the UK, Ireland, Germany, Poland, Austria, and the Netherlands.

Who is the CEO?

The company was founded nearly 40 years ago, in 1987, by a man named Bernard Cammarata. Today, he’s the Chairman and still owns 83,000 shares or $9m worth - which is not much tbh considering the size of the company ($124 billion)!

The current CEO of TJX Companies is Ernie Herrman. He was made CEO in 2016 and has been at the company for 26 years! He owns about $50m worth of stock.

THE NITTY GRITTY

What is the market share?

The TJX business model - buying excess or end-of-line stock from retailers and then selling it at prices generally 20% to 60% below full-price retailers’ regular prices - means it is a bargain hunter's dream destination.

Currently their market share is 45.4%

Is the industry growing?

And in the current economic climate, when everyone is trying to save a dollar anywhere they can, this plays right into TJX’s hands.

This is what we call ‘trading down’ - when consumers who might usually dine at fancy restaurants, are now buying McDonalds because it's cheaper. Other companies that would benefit from trading down like TJX are Walmart and CostCo.

On the supply side, right now retailers are also struggling to move stock, as inflation means higher prices which people can’t afford. Soooo, they sell them to TJX 👏

THE FINANCIALS

TJX has a history of strong financial performance, with consistent revenue growth and profitability. Their ability to offer quality products at lower prices helps them attract and retain a large customer base.

Even during economic downturns, their numbers have been pretty resilient.

For any retail store, one of the key stats is Same Store Sales growth. This effectively shows ‘how much is each store growing’ aka how healthy is their store network. If more people are going to the stores, that is good! If less and less people go to the stores, that is bad. Anything around 3% or above is positive!

For TJX, Comp store sales grew by 3% in the latest quarter, driven by increased customer transactions. This is a green flag as most retailers could just increase price to improve their SSS growth but for TJX, it was mainly driven by increased transactions (aka people buying more stuff). This is a very healthy indicator.

Balance Sheet:

It has a ‘net cash’ position, meaning it has more cash than debt. This means the company will be able to whether any rainy day ahead

THE SHARE PRICE

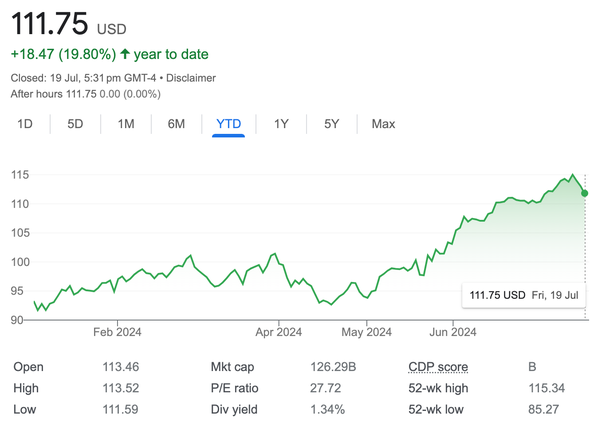

YEAR TO DATE (YTD) TJX +18% vs Index (S&P 500) +16%

OUTPERFORMANCE OF 2%

PAST 12 MONTHS: TJX +37% vs Index (S&P 500) +25%

OUTPERFORMANCE OF 12%

DO THEY PAY A DIVIDEND?

Yes, TJX Companies pays a dividend. As of 2024, the company has announced a quarterly dividend of $0.375 per share, which represents a 13% increase from the previous dividend.

So if you owned 1000 shares of TJX ($100k), you would get a $375 each quarter

THE RED FLAGS

Think: Industry, competitors and company specific.

THE BIG PICTURE FLAGS

If we come out of a recession and the cost of living crisis and people start feeling more confident, this could negatively impact TJX as people decide to shop elsewhere

The Industry Flags:

TJX operates in the retail industry meaning a big risk for them is change in tastes and fashion. However, considering how long they have been operating for gives me some comfort they know what they’re doing

It employees over 350k staff globally. Should there be any changes to minimum wages, this could lead to increased costs. However, a lot of other retailers will be impacted too.

In terms of competition, there is always a threat of new and exciting discount retailers entering the US and taking share off TJX e.g just like Temu is taking share off Amazon..

The TJX Specific Red Flags:

The CEO has been in his role for 8 years, and at the company for 26 years. There is always a risk he could want to leave, especially because he doesn't own a huge amount of stock, he is not hugely incentivised by the long-term success of TJX

THE VIBE CHECK

The Good Vibes

Unique business model

Resilience and recession-proof nature of this business

The good vibes

Huge variety of stores (seven different brands)

Net Cash

THE BAD VIBES

CEO doesn't own a lot of stock

THE BAD VIBES

Susceptible to changing trends and tastes